Create an account

Register for account.

Register for account.

Watch the videos for as long as you want. No Exam! You may pause and continue watching video at anytime.

After watching all the videos, simply click "Print Certificate" to print a copy of your certificate. A copy will also be emailed to you.

Conducting Open Houses and Developing a Safety Plan This course is designed to provide insight and understanding on how to properly and safely conduct an open house that provides a safe environment for both the homeowner and the real estate agent. After successful completion of this course, students should have gained the necessary knowledge to successfully execute an open house and they should also be aware of the potential dangers associated with hosting a property viewing.

This course is designed to give students a comprehensive understanding of Comparative Market Analysis (CMA) in Real Estate. Throughout this course, students who have successfully engaged in the course will have obtained in-depth knowledge and understanding of all things related to Comparative Market Analysis. Students can expect to learn the following: common uses of a CMA, advantages, and disadvantages of CMA, elements of a CMA, etc.

The course is designed to describe the different real estate advertising compliance laws in the state of Massachusetts. Furthermore, this module intends to discuss the different ways to advertise properties, fair regulations in advertising properties, and the consequences involved when practicing without a license. At the end of the module, the students are also expected to review and summarize sample advertisements.

This course is designed to provide an understanding of flood zones, flood maps, flood insurance, and considerations real estate licensees need to make when a client is buying or selling a home in a flood zone. After completion of this unit, students should demonstrate an understanding of what issues a real estate licensee might face when working with a client who is selling a property in a flood zone.

This course is designed to provide an understanding of laws, factors, reports, documents, background, and guides on pre-foreclosure and foreclosure processes.At the completion of this course, students should be able to demonstrate an understanding of different types of foreclosures, pre-foreclosure processes, foreclosure processes, auction and after auction processes, and laws relating to foreclosures.

Understanding the Basics of Reverse Mortgage Real estate agents are often the first point of contact when people start to make housing changes. Having a basic knowledge of the Reverse Mortgage product will help licensees to better serve their clients and customers. As baby boomers consider downsizing, upsizing, aging in place, or making any housing transitions, all options can be presented. It is advisable to also have a list of experts in the field of finance and financial planning to assist them.

The course is designed to help real estate agents gain a deeper understanding of auctions, distinguish the key differences between types of auctions, and identify the components of a bid package. Students can expect to learn how auctions work and guide students on how to buy a house if a house ends up for auction.

This course is designed to provide an understanding of mortgages, consumer credit, loan options, and how home equity can be utilized. Students can expect to learn about the primary mortgage market, the sources that fund it, and the ins and outs of these loans for both parties.

Investment Property Basics Students who have duly dedicated themselves to the class would have gained in-depth knowledge of the basics of investment properties. This includes the valuation process, economic variables, and other relevant principles to investing in a property.

This course is designed to provide an overview of how real estate properties are appraised and what factors affect the market value of a property. This course also outlines the appraisal process, who makes the appraisal, and what an appraisal report contains.

A two hour course explaining the concept of a short-sale. Students can expect to learn how to work with a client in closing a short-sale deal. Students will learn about lender expectations, do’s and don’t of a short-sale transaction, delinquency requirements, and more.

A two hour course designed to increase an agent’s understanding of the role of a Property Management rules and regulations. Students can expect to learn about duties of a property manager, PMA contract agreements, and areas of responsibilities (Marketing, Financial, etc).

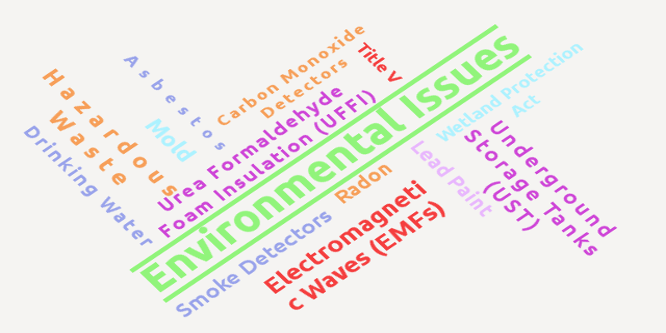

A two hour course designed to increase an agent’s knowledge and understanding of Environmental issues relative to the real estate industry: including but not limited to the following topics: Lead Paint, Title V, Asbestos, Radon, Hazardous Waste, Smoke Detectors, Mold, Smoke Detectors, etc.

A two hour course designed to increase sensitivity related to antitrust in the real estate profession. Students can expect to learn about antitrust concepts such as: law and oversight, violations, enforcement, risk education, and more.

A two and half hour course that satisfies (NAR) National Association of Realtor’s biennial Code of Ethics requirement. Agents will learn about duties to customers, duties to the public, duties to other realtors, enforcement of code of ethics violations, and a lot more.

A two hour course which explains different contractual agreements a real estate agent might encounter during a transaction. Sample topics covered: offer and acceptance, types of contracts, elements of a contract, statue of fraud, termination, remedies of a breach, and more.

A two hour course covering various aspects of fair housing rules and regulations. Students can expect to learn about protected classes, exemptions from Fair Housing, prohibited discriminatory practices, advertising and marketing, American with Disabilities Act (ADA), etc.

A two hour course which explains various financing options available today. Students can expect to come out with a more in-depth understanding about loan origination, primary loan application, types of loans, loan terms, sources of financing, and a lot more.

A two hour course which explains various aspects of leasing and contracts. Students should expect to learn about valid and invalid contracts, types of leases (office lease, ground lease, etc), various lease durations, termination of leases, breach of terms & conditions, and more.

A two hour course which delves into all the dynamics of today’s residential mortgage financing market including but not limited to credit reporting and credit scoring, FHA loans, VA loans, who qualifies for these loans, PMI (Private Mortgage Insurance), and a lot more.

A two hour course which explains the appraisal process. Students can expect to come out with a better understanding of how appraisal is used in Massachusetts. Concepts such as the three appraisal approaches (Sales, Income, and cost) will be explained, etc.